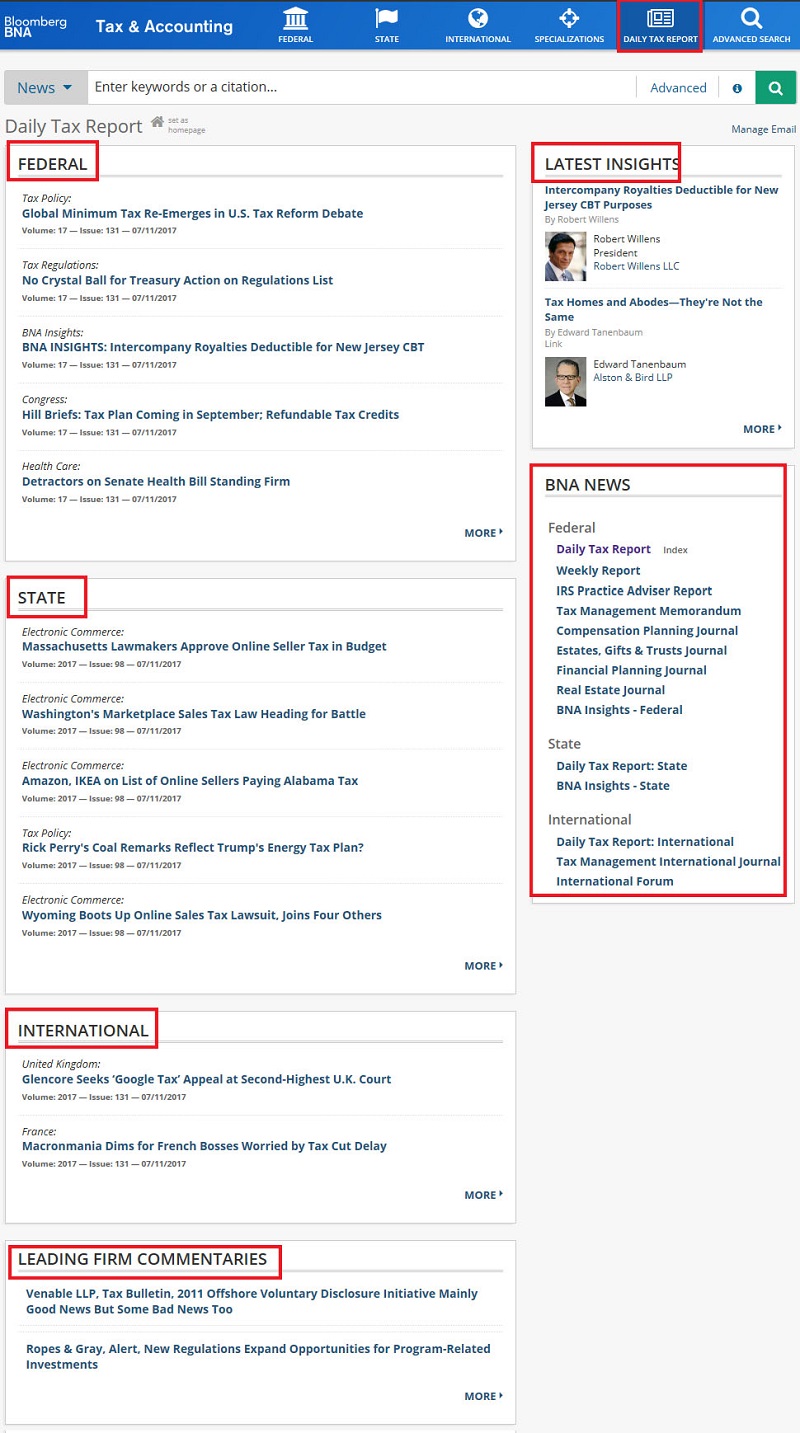

Daily Tax Report - News Content

The Daily Tax Report homepage compiles the day’s news and organizes it under broad subject areas: Federal, State, International, and Leading Firm Commentaries.

Latest Insights, written by tax practitioners, are linked on the right hand frame.

Individual issues of BNA News products are also sorted by broad subject areas: Federal, State, and International,

with links to the current issue.

Holdings

The following publications are included in Bloomberg Law: Tax

DAILY TAX REPORT ®

Coverage of legislative, regulatory, and legal tax

developments.Frequency: Published each business day, except federal holidays

Archived Date: Back to January 3, 1994

DAILY TAX REPORT : INTERNATIONAL

Single resource for keeping up to date on the latest tax developments

from across the globe; combines news and updates on statutes,

regulations, court decisions, treaties, and policy developments from the

leading Bloomberg BNA international tax publications.

Frequency: Published each business day

Archived Date: Back to April 1, 2014

*Previous title: International Tax News

DAILY TAX REPORT: STATE

Coverage of state tax regulation relating to income and franchise taxes, sales and use taxes, property taxes, and miscellaneous taxes.

Frequency: Published daily

Archived Date: Back to January 10, 1997

*Previous title: Tax Management Weekly State Tax Report, published weekly.

TAX MANAGEMENT WEEKLY REPORT™ Taxation-related coverage of federal legislative, regulatory, judicial, and policy developments.

Frequency: Published each week

Archived Date: Back to June 21, 1999

IRS PRACTICE ADVISER REPORT

Definitive report on IRS procedural developments, IRS positions, and new IRS trends and techniques.

Frequency: Published each month

Archived Date: Back to December 11, 1998

TAX MANAGEMENT MEMORANDUM™

Coverage of issues, developments, trends, and strategies in business tax planning.

Frequency: Published every other week

Archived Date: Back to May 24, 1999

JOURNALS

COMPENSATION PLANNING JOURNAL™

Coverage of compensation planning issues, such as qualified plan

compliance, taxes, benefits, and non-qualified deferred compensation.

Frequency: Published each month

Archived Date: Back to May 7, 1999

ESTATES, GIFTS & TRUSTS JOURNAL™

Coverage of developments and trends in estate planning.

Frequency: Published every other month

Archived Date: Back to May 13, 1999

FINANCIAL PLANNING JOURNAL™

Coverage of economic trends, Social Security and Medicare, and income tax, investment, retirement, and insurance planning.

Frequency: Published each month

Archived Date: Back to April 20, 1999*

INTERNATIONAL JOURNAL™

Coverage of tax developments affecting international corporate and individual transactions.

Frequency: Published each month

Archived Date: Back to June 11, 1999

REAL ESTATE JOURNAL™

Coverage of real estate tax planning, including passive loss rules,

tax-free exchanges, workouts, REMICS and REITs.

Frequency: Published each month

Archived Date: Back to May 5, 1999

TAX MANAGEMENT INTERNATIONAL FORUM™

Practitioners provide expert guidance on cross-border tax planning

questions on a country-specific basis.

Frequency: Published quarterly

Archived Date: Back to June 15, 2003

Daily Tax Report

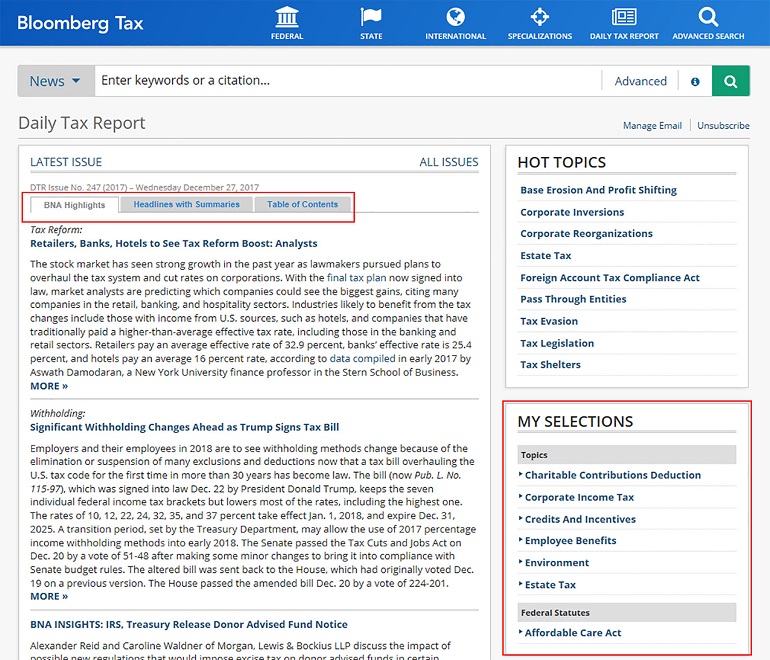

The Daily Tax Report™ homepage compiles the day’s news and organizes it under these subject areas: Federal, State, International, and Leading Firm Commentaries.

Latest Insights, written by tax practitioners, are linked on the right-hand frame.

Click between tabs to view the issue with BNA Highlights or Headlines with Summaries.

Click Sign Up for /or/ Manage Email Updates and select a subscription preference and/or customized topics. The selected topics are included in Email updates and also display in the My Selections frame on the Daily Tax Report subscription homepage.

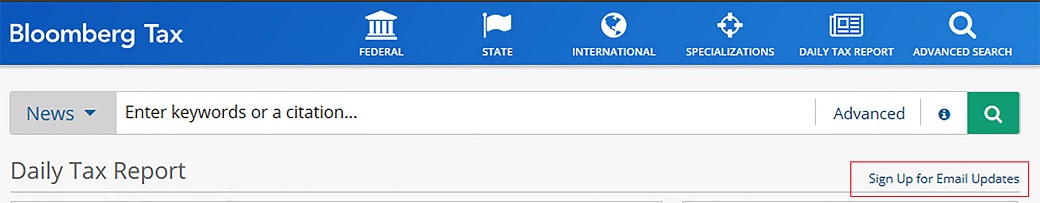

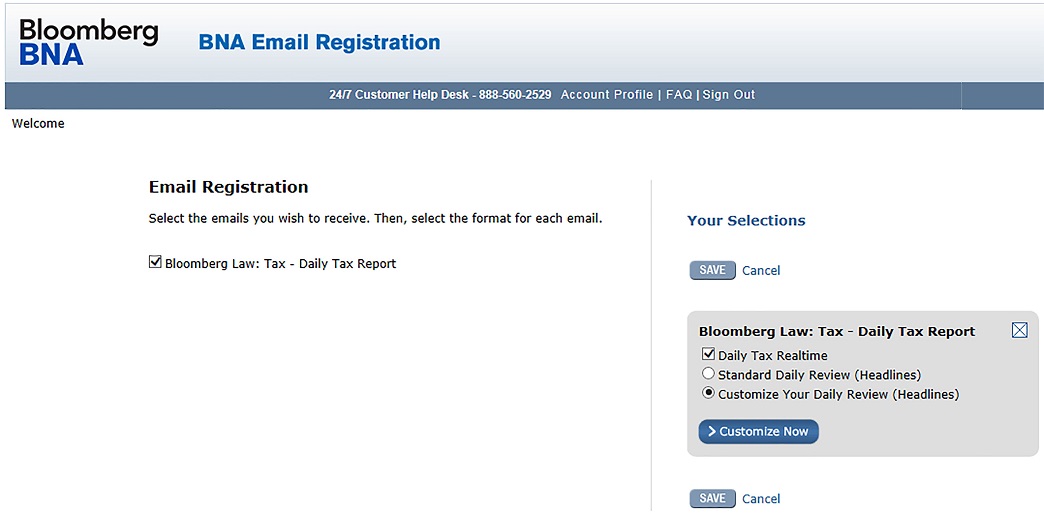

Create and Manage Email Updates

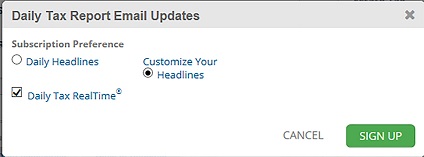

Click Sign Up for Email Updates.

Select Customize Your Headlines on the pop-up dialog box.

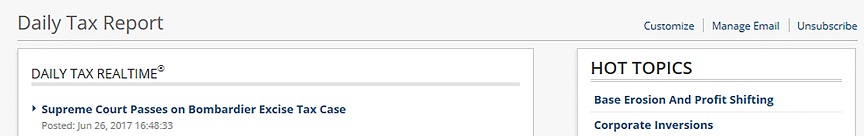

The links redisplay at the top of the page. Select Customize

The Customize screen displays. Make selections for Topics, Courts, Federal Statutes, States, and Countries to appear at the top of your email alerts. Make your selections and click Save.

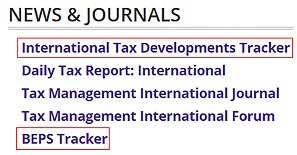

State and International Tracking Tools

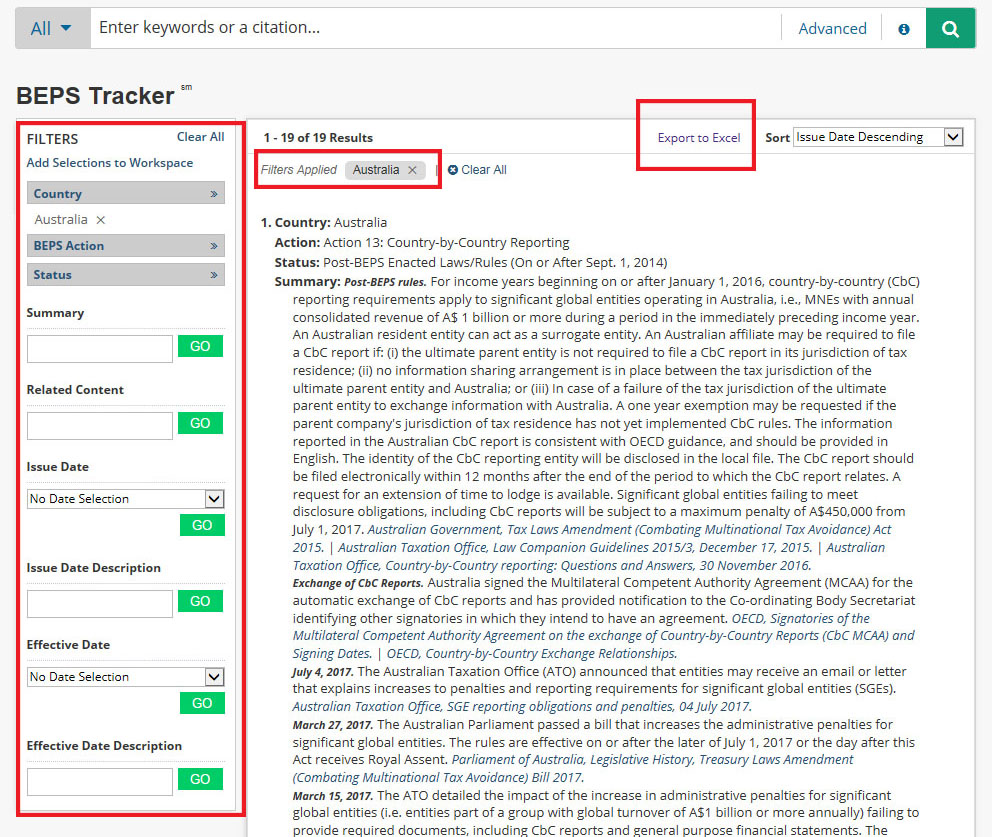

Use Bloomberg BNA to track and summarize daily developments across a range of state and international tax topics. Selectively filter by jurisdiction, topic, type of tax, and date range to easily track developments on the State Tax Developments Tracker, BEPS Tracker SM, and the International Tax Developments Tracker.

Use the State Tax Developments Tracker tool to narrow or expand the data either by sorting by State, Date Ascending or Date Descending or by using filters found on the left side of the screen.

Choose to Show or Hide the Details.

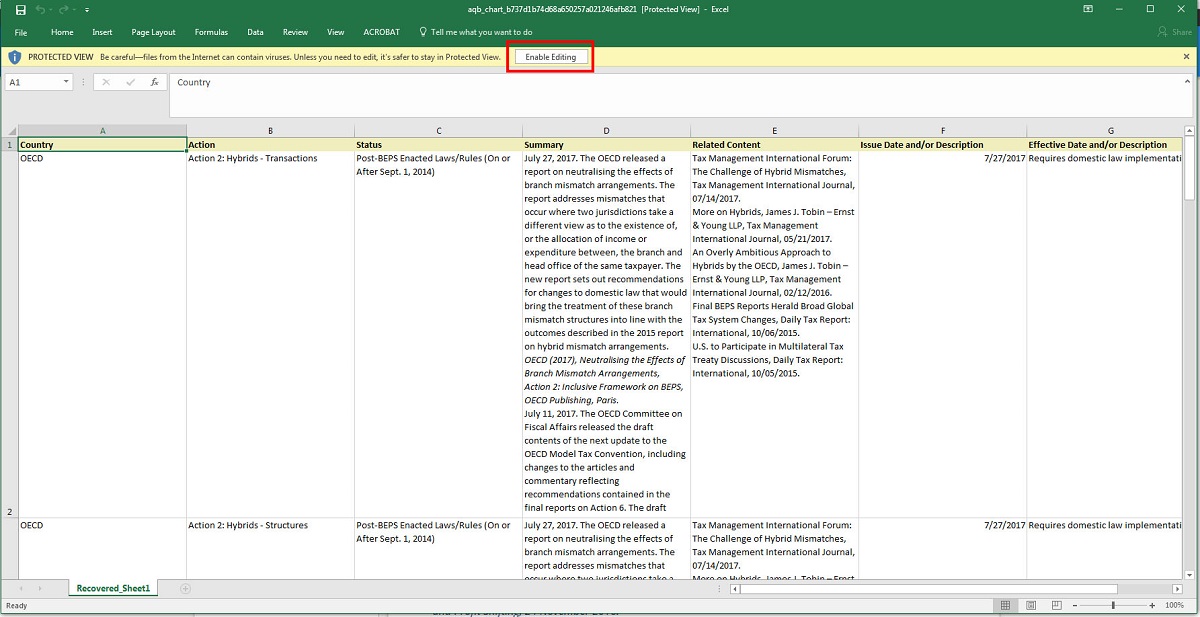

Use the Export to Excel option to manipulate the data.

Use the Filter Tracker to create a customized listing. Make selections in each filter and click Apply or GO as applicable.

Click Clear All to start from scratch or click the X to remove individual selections.

![]()

BEPS Tracker

The BEPS Tracker offers you an additional tool for tracking country-by-country developments in response to the OECD's Base Erosion and Profit Shifting (BEPS) action plan. Filters allow you to narrow by country, specific BEPS action, status, keyword and date. Your results can be sorted to display by any of these criteria. Access the BEPS Tracker on the International tab, News & Journals frame.

Use the filters to locate the actions you need, and Export to Excel to view the results in a spreadsheet

where you can manipulate and print the data.